This practice is sometimes referred to as "segmentation", which relies on a more active approach.

She comments: "Where segmentation is used, a review is carried out and different default funds or options are configured for different segments of DC members, based on the characteristics of those particular members.

"This will look at reasons why members are likely to want to invest in certain investments over others - for example, are they able to take more investment risk, or do they value stability over potential for greater investment growth, or do they want to draw down their benefits?

"The important thing here is to communicate the pros and cons of different funds", Ms Baker adds.

But according to Jason Green, head of workplace research for F&TRC, having too much choice of funds can be confusing and therefore unhelpful in an auto-enrolment context.

He explains: "Offering a range of lifestyle funds, alongside a number of more diverse funds, we would see as optimal.

"More is not always necessarily the best. Having a smaller, well-managed and controlled fund range is better than offering thousands.

"If people are given a limited choice, they are more likely to make a decision, while too much choice is overwhelming."

Duty of due diligence

Employers and trustees of schemes have specific duties when it comes to assessing and monitoring the investment performance of the pension scheme.

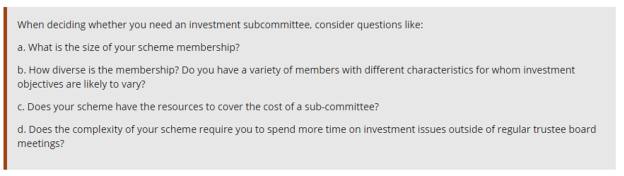

According to The Pensions Regulator (TPR), many schemes may consider setting up independent investment committees who can assess whether the underlying funds - including the default funds - are doing what they are expected to be doing.

There is a useful checklist on the regulator's website to help those involved in the monitoring and establishment of appropriate auto-enrolment investment portfolios, as well as information on what an independent committee or investment sub-committee - which could comprise the external financial advisers - should be examining.

Figure 1: What an investment subcommittee should consider (Source: TPR)

According to Chris Daems, director of Cervello Financial Planning, advisers too have a duty to examine whether the funds - default or otherwise - are diversified enough, and monitored adequately.

Advisers should also pay attention to total costs, performance and risk profiling, as well as the underlying investment choice.

Yet first and foremost, advisers have to make sure the employer (who is usually the client) is fully aware of what they are buying on behalf of their staff members.

Mr Daems says: "It is important to understand that, when we work in partnership with a client to support them with auto-enrolment, the client is usually the employer, not the individuals who are saving in the pension scheme.